Table of Content

If you donât have remaining entitlement, youâll have to request a one-time restoration of your VA loan benefit if you pay off the existing VA loan but keep the home. Though there are plenty of good reasons to get a VA home loan, there are also some disadvantages you should know about. When you have checked and are eligible, you can plan to acquire real estate to get passive income. If you own your home, you might need to get more units to make some money from them. The VA loan benefit was created to help military servicemembers achieve financial stability and claim their piece of the American dream in honor of their service to the country.

The SBA 504 loan is the best choice for buying commercial property. Money can be used to buy a building, finance ground-up construction, or rehab an existing building. With the SBA 504 loan, you are likely to have the lowest interest rates and a 25-year repayment term. Veterans and service members who want to purchase multiunit properties often see it as an investment opportunity. For many people, the idea of having tenants help pay some or even all of the mortgage is appealing.

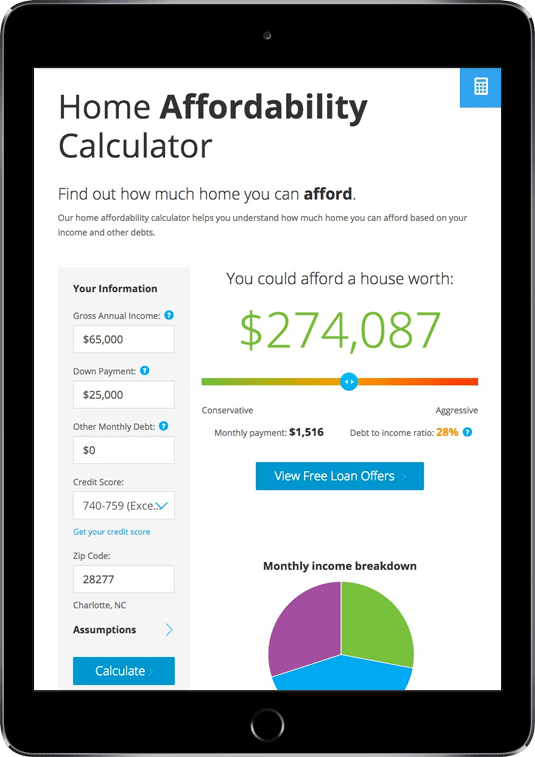

Affordability Calculator

Your total household expense should not exceed $1,290 a month ($3,000 x 0.43). Lenders have a pre-qualification process that takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. This is the total amount of money earned for the year before taxes and other deductions. If you have a co-borrower who will contribute to the mortgage, combine the total of both incomes to get your annual income. Debt-to-income calculatorYour debt-to-income ratio helps determine if you would qualify for a mortgage.

When this happens, you’ll likely feel tempted to start renting the property out to another tenant. Here’s what you need to understand about VA loan requirements and how they influence your ability to rent out your home. A term of occupancy clause is not typically included in VA-guaranteed mortgages, so borrowers are not required to remain in their homes for a certain length of time. You do not have to worry about a prepayment penalty if you intend to sell your property in the near future.

options.instance = e.id

The Department of Veterans Affairs will only back VA loans if the buyer will live in the home for at least one year. Some homeowners wonder if they can also tap the benefits of VA loans for an investment property. FairwayNEXT provides convenient ways to obtain valuable information about your mortgage loan, such as where to make your first payment as well as who your current servicer is. 75 percent of $1,400 is $1,050Subtracting $1,050 from your $2,000 mortgage payment gets you a payment of $950With no additional debts, your income required to qualify drops to $2,317 a month.

In some cases a borrower using a VA loan may be able to use the existing or projected income from the property being purchased to help meet the income requirements a lender has for a borrower. A lender will generally count 75% of a property’s rental income as part of a borrower’s total income. When you buy a multi-unit property as a homebuyer, you can typically use future rents on the property to help you qualify for the loan. Most lenders allow you to use 75% of the market rent for the rental units in a multi-family home, which accounts for expenses such as vacancy rate and maintenance. Some want to see a track record of success as a landlord as well.

Current Mortgage Rates by State

Make sure youre working with a lender who has experience using rental income for VA loans. VA loan rental income documentation requirements depend on the rental history of the property. Fortunately, VA loans are not a one and done type of eligibility thanks to bonus/second-tier entitlement. One such use involves retaining one property while buying a new primary residence.

It is important to note that 75% of the verified rent amount can be considered rental income if it is already rented out. The borrower has extensive experience as a landlord or prior experience managing a multi-family property. It is easiest to discuss what will happen if the property that was first secured by the VA loan has been paid off, and you wish to keep it.

Veterans and active military may qualify for a VA loan, if certain criteria is met. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage. VA loans can be a great way for qualifying active and former military members to purchase investment properties. Once you have secured financing and purchased a suitable property, you can use the rental income to offset or cover your mortgage payments in full. VA home loans are an attractive funding option for many service members. As long as you live in one of the units as your primary residence, you can buy a property with up to four units.

In New York State it is licensed by the Department of Financial Services. Please click here if you do not wish us to sell your personal information. When qualifying for your second home loan, you might have trouble meeting your lender’s debt-to-income guidelines. Others think they’d need to refinance out of the VA loan program altogether before renting out their home. When you refinance with the VA cash-out refi, you’ll need to occupy the home for at least another year, based on the VA’s occupancy rules. And, keep in mind that, regardless of the VA’s loan limits, your lender will limit your loan amount based on your credit score, other debts, and personal finance details.

You may be subject to capital gains tax if you sell your home within two years, regardless if it is VA-backed or not, and make a profit. VA loans are not meant to be used for the purchase of investment properties or rental properties. The fact that a VA loan is an assumable mortgage should not frighten you if you decide to sell the property.

And although these loans are backed by the Veterans Administration, you’ll also have to meet your lender’s credit and income requirements in order to be approved for financing. You can have two VA mortgages as long as you can still meet the occupancy requirement for VA loans. This typically applies if you purchase one home with a VA loan, and then you’re permanently restationed to a different location. As an added bonus, service members and veterans get access to VA loans, which often come with more favorable terms and fewer upfront costs than traditional mortgages. Additionally, you can use a VA loan to purchase an investment property, making it a potentially profitable opportunity for those who serve or have served in the military.

This means you could purchase a home with a VA loan, sell it later on and get another VA loan for your next home. Just remember, even with investment properties, you have to occupy the home to qualify for a VA mortgage. So, yes, it is possible to use your VA loan for rental property, bearing one of the units is your primary residence. Using your VA loan benefit on an investment property isn’t so cut-and-dry, however.

The Department of Veterans Affairs allows VA homebuyers to purchase multi-unit properties with the intention of using one of the units as their primary residence. Potential homebuyers are often drawn to the appeal of using their VA home loan benefit on an investment property. Doing so can bring in extra revenue and, in some cases, pay off your mortgage. Learn more about the line items in our calculator to determine your ideal housing budget. Like most conventional mortgages, loan applicants need to have cash reserves at closing.

Realtor.com is hosting and helping to administer and promote the sweepstakes. VA Jumbo Loans Explained VA jumbo loans offer a way for Veterans and other military members to purchase a home in more expensive regions of the country. Use our VA home loan calculator to estimate how expensive of a house you can afford. Refinance calculatorInterested in refinancing your existing mortgage?

Following this rule aligns your new home loan with the VA’s primary mission of helping veterans buy safe and affordable housing at competitive interest rates. After all, most of us buy our primary residences expecting their value to grow even though we know homes can lose value, too. As of this writing, there is a 3,700 square foot duplex in Las Vegas, NV with a sale price of $315,000. Using other peoples money by getting a loan on a rental property can be a good way to increase potential returns as long as you conservatively balance risk with reward.

No comments:

Post a Comment